To Molly Marsh, CMP, director of education and engagement design at AMR Management Services in Lexington, Ky., operating in today’s business environment means mastering the unpredictable.

“Uncertainty is the name of the game right now,” says Marsh (MPI Kentucky Bluegrass Chapter). “I don’t know that I have a lot of leveraging power right now.”

While Marsh felt like she was in a good place when negotiating 2016 and 2017 contracts, “since then it’s gotten harder and harder,” she says.

A big challenge she is facing is explaining to corporate leaders and board members that they can’t get the same thing today at last year’s prices. Room rates and costs for food and beverage and audiovisual are going up faster than in the past, she says.

“Coffee really does cost US$120 a gallon,” she says. “We have to be really careful and thoughtful about that, so there’s no surprise that there’s a big bill at the end.”

As this quarter’s survey found, the business environment has been stable but is now showing signs of slowing down. Many meeting professionals reported concerns about “instability.” Overall business condition projections are the lowest reported in more than three years.

Interestingly, there was a big difference between planner/supplier responses, with 40 percent of planners saying conditions are favorable but 60 percent of suppliers saying the same.

Frugality in a Seller's Market

In the current landscape, some planners find they have to keep a watchful eye for surprise fees. Marsh finds that properties and venues are putting new policies in place that pass along charges to clients who signed contracts in the past, resulting in unexpectedly large bills.

“We’re having to fight that so much more,” Marsh says. “They can put a charge on your bill and if you don’t say, ‘That’s not in the contract. You can’t do that,’ you’re going to pay it.”

She is not alone. When Anita Carlyle, CMP, CMM (MPI Toronto Chapter), managing partner of MCC Destination Management in Toronto, booked a three-night corporate event for 300 attendees at a hotel in Ontario last year, the property unexpectedly tacked on a 9 percent “environmental fee” that will go to “new environmental strategies for the hotel.”

“It’s almost like they’re trying to guilt you into accepting this extra,” Carlyle says.

That charge is one of several unexpected fees she’s seen on the final bills for events lately. She tries to fight them but sometimes finds it’s futile.

“I think [suppliers] are taking advantage right now that it’s a seller’s market,” Carlyle says. “And they are trying to get extra bottom-line revenue anywhere they can.”

Beyond that, the survey showed other indications of an economic slowdown, with 64 percent of respondents saying economic instability is affecting business decisions and 53 percent reporting that political instability is doing the same.

Shelley Mann, CMP (MPI Kansas City Chapter), event director for Vizient, a member-driven healthcare performance improvement company in Kansas City, Kan., has faced belt-tightening in her organization, which is keeping a close eye on costs under the leadership of its CEO, who was the CFO until about a year and a half ago.

“He’s really seriously watching the money and how we spend,” Mann says.

For the two meetings the group holds in Las Vegas annually, Mann has adjusted F&B options to fit current budget restrictions, opting for a continental breakfast with a hot item to go with it, rather than a full breakfast, for instance. For lunches, the company has limited the number of invitations, to keep costs down.

It isn’t just the economy that is driving the budget-consciousness.

“A lot of it has to do with the healthcare industry,” Marsh says. “You don’t want to put on a huge meeting with all the elaborate hoopla. Our CEO and executive team don’t even take limos from the airport or the hotel. They don’t want the impression of them taking a limo to our members and suppliers.”

The survey also showed a slight uptick in respondents citing international trade wars as negatively affecting their meetings/events. Meanwhile, there was some softening across all types of employment, and attendance projections were slightly down.

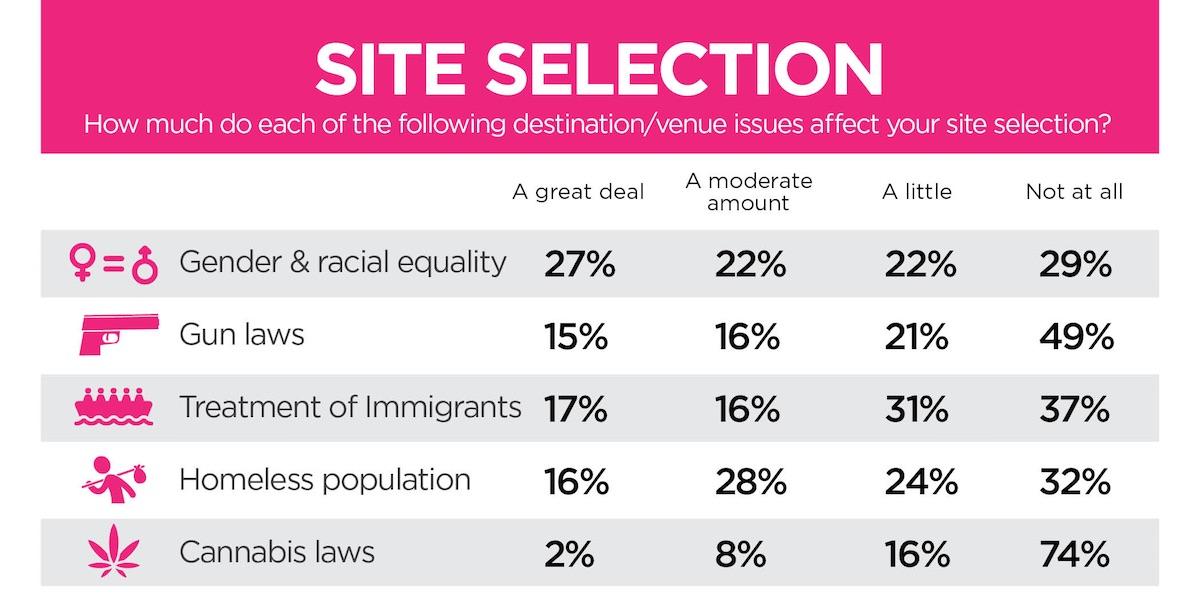

In the fall 2019 Meetings Outlook report, read more about the uncertainty shaping the near-future business landscape and how meeting pros are and are not augmenting efforts due to climate change, as well as insights into other key trends (such as the various social issues affecting site selection, teased in the graphic).

Meetings Outlook is supported in partnership with IMEX Group.