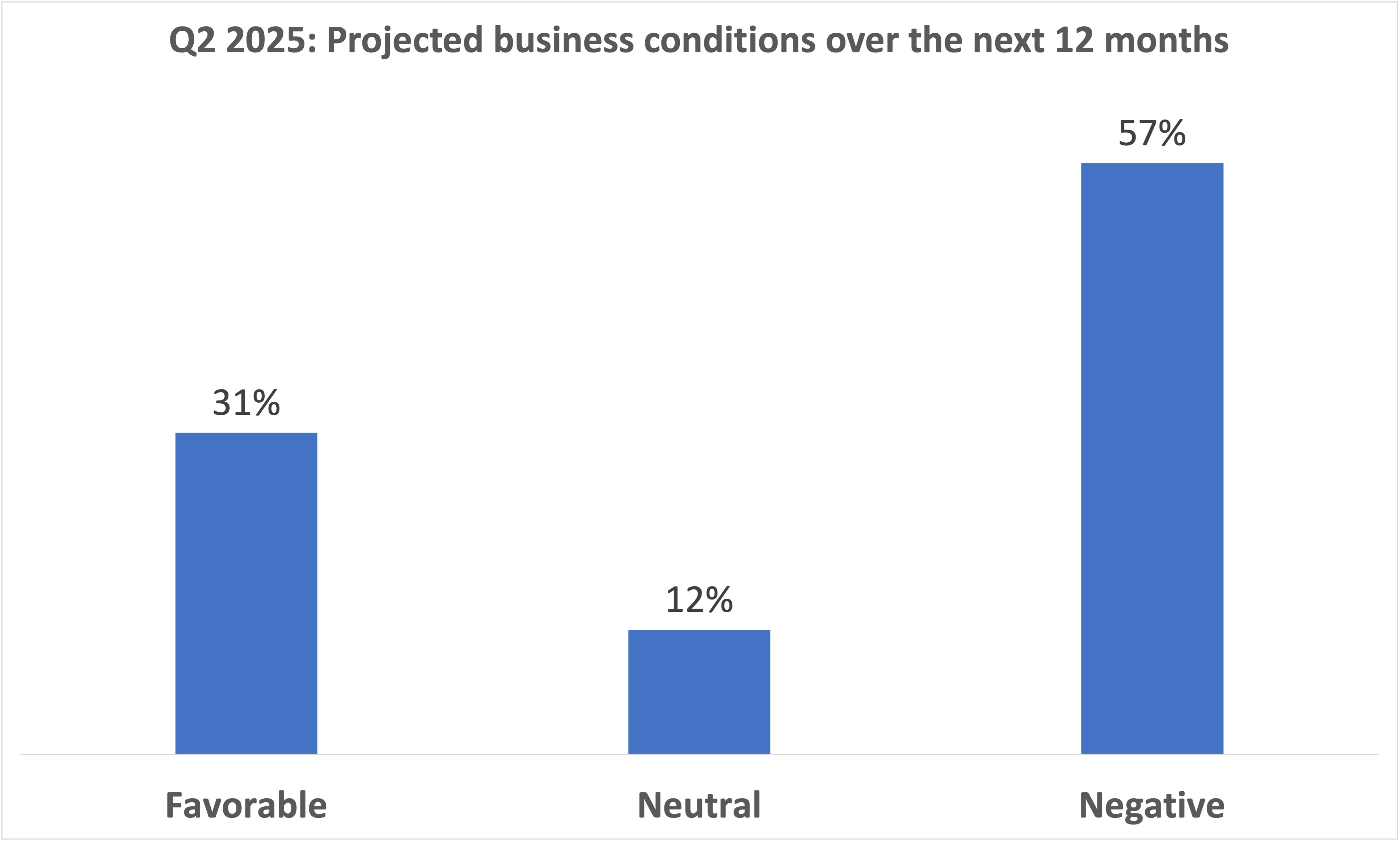

A majority of meeting and event professionals anticipate negative business conditions over the next year, according to MPI’s Q2 2025 Meetings Outlook survey; only 31% of respondents expect favorable conditions

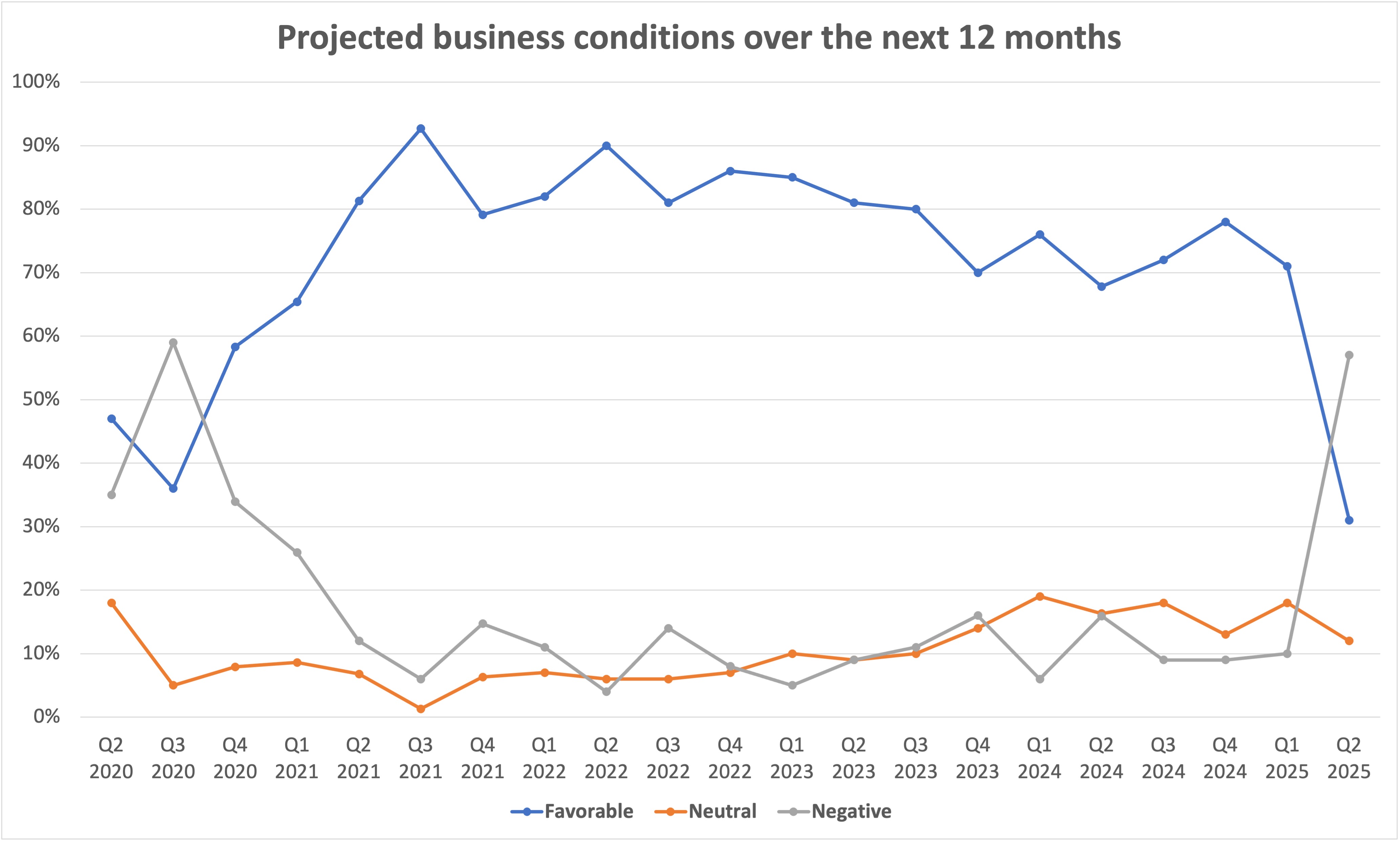

The only time Meetings Outlook research has seen positive sentiment results close to this level was nearly five years ago (Q3 2020), as businesses and society at large got a glimpse of the severity of the nascent COVID-19 pandemic and were starting to respond. Even then, the positive sentiment forecast was greater than in this most recent quarter (36% and 31%, respectively)

Here's a look at this data point over the past 21 quarters—tracking event professionals’ business expectations for “the next 12 months,” from the first half of 2020 to April 2025.

It’s important to understand that the data revealed in the Q2 2025 Meetings Outlook results is not a trend—right now, it represents a single quarter in which prior trends were disrupted. Granted, these results are startling, but they’re just a snapshot of the period in which survey responses were received. Should similar results appear in subsequent surveys, only then can this shift be discussed as a trend.

When was this survey executed, what was going on?

Between March 31-April 11, the Q2 2025 Meetings Outlook survey received a total of 230 unique responses (53% from suppliers, 47% from planners). When evaluating the data, one must consider the greater economic and geopolitical landscape leading up to the survey and while responses were being collected.

That period of time saw significant volatility in financial markets and geopolitics. On April 2, U.S. President Trump announced “reciprocal tariffs” for goods from most countries and a 10% tariff on all imports, expanding on the tariffs directed at Canada and Mexico announced during his first day in office (Jan. 20). China, notably, responded to the new tariffs by announcing new tariffs of their own on U.S. goods. In the following days, financial markets worldwide experienced severe volatility, with many stock exchanges seeing the greatest selloffs since the start of the pandemic in 2020. On April 9, Trump announced a 90-day pause on the “reciprocal tariffs,” reversing many market downturns from the previous days.

Meeting and event professionals are clearly seeing how uncertainty injected by such volatile shifts can cause nearly instant ups and downs that reverberate around the globe and can disrupt myriad aspects of the event business. (Learn about how recent U.S. executive orders and policy changes are affecting event pros.)

Notably, while the overall business projection data this quarter is the least-positive seen in the history of Meetings Outlook, several other data points—such as budget and in-person attendance projections—were worse in 2020 (more on that in the weeks to come). Thus, even though there are some similarities between the present data and that of 2020, the variables driving these shifts differ in many ways. Accordingly, the path forward for meeting and event professionals working to overcome these challenges may also vary

This data is but a piece of the larger Q2 2025 Meetings Outlook report, which will be published online during the second half of May.