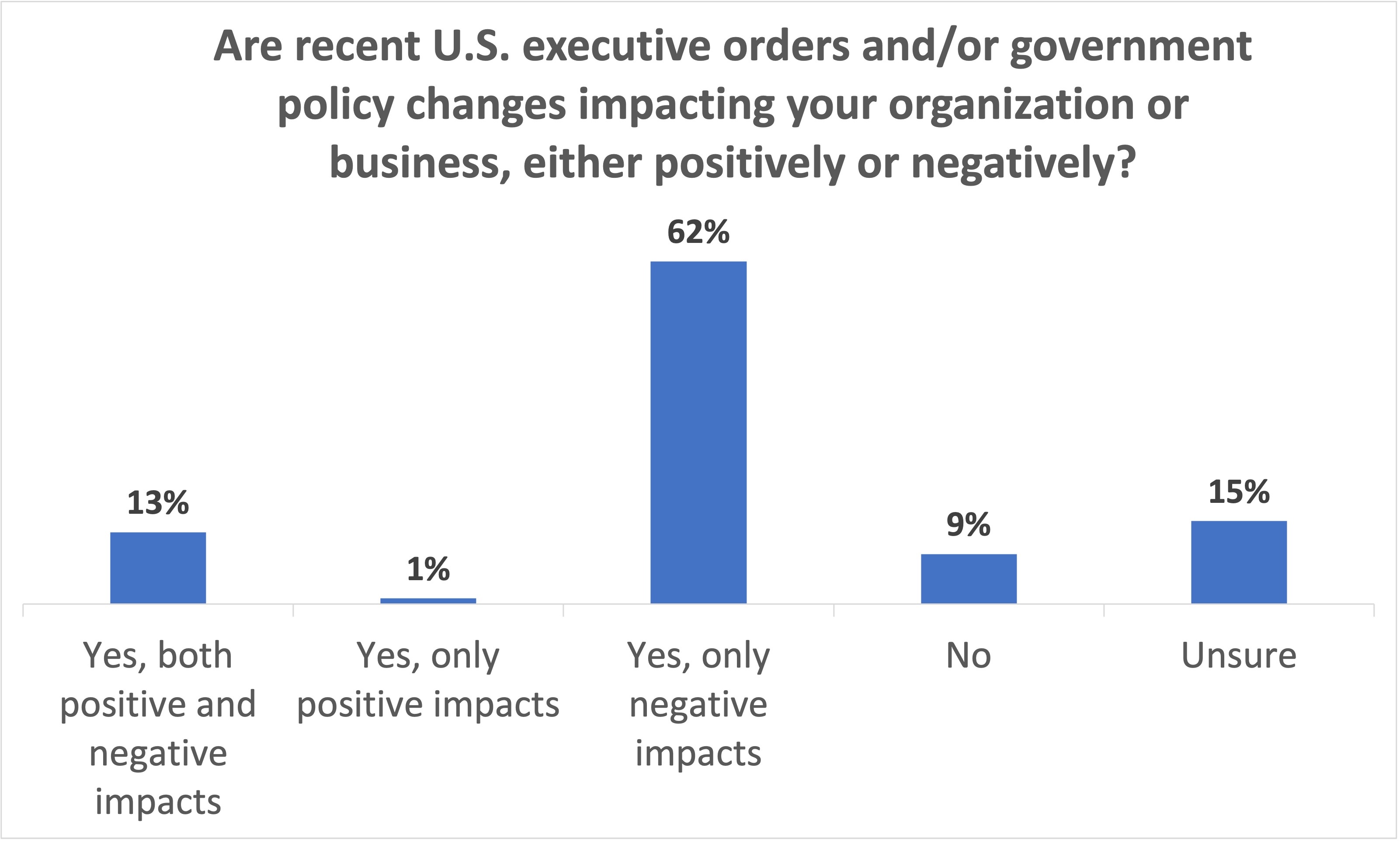

According to data from MPI’s Q2 2025 Meetings Outlook survey, a majority of event professionals are experiencing significant negative impacts on their business due to recent U.S. executive orders and policy changes.

Three-quarters (75%) of survey respondents said these actions are already having a negative impact on their business. In fact, 62% of respondents report only negative effects.

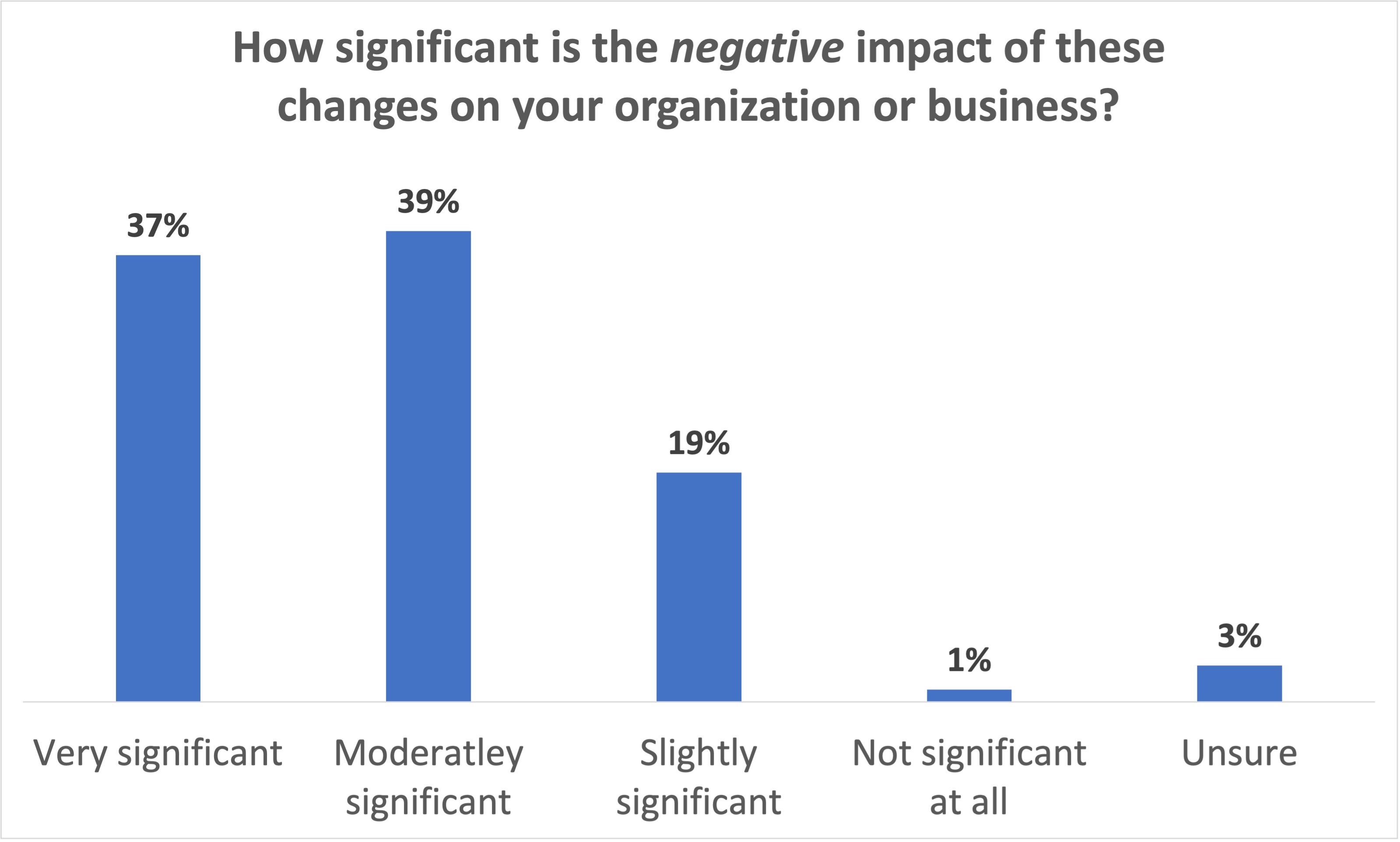

And, for most, these negative effects aren’t minor: 76% of affected respondents labelled the severity of these impacts as “very significant” or “moderately significant.”

Between March 31-April 11, this Meetings Outlook survey received a total of 230 unique responses (53% from suppliers, 47% from planners). When evaluating the data, it’s important to consider the greater economic and geopolitical landscape leading up to the survey and while responses were being collected.

For context: On April 2, U.S. President Trump announced “reciprocal tariffs” for goods from most countries and a 10% tariff on all imports, expanding on the tariffs directed at Canada and Mexico announced during his first day in office (Jan. 20). China, notably, responded to the new tariffs by announcing new tariffs of their own on U.S. goods. In the following days, financial markets worldwide experienced severe volatility, with many stock exchanges seeing the greatest selloffs since the start of the pandemic in 2020. On April 9, Trump announced a 90-day pause on the “reciprocal tariffs,” reversing many market downturns from the previous days.

Such volatile shifts increase uncertainty in the business landscape which, in turn, can disrupt myriad aspects of the event business.

Respondents made it clear, however, that the negative impacts on their businesses aren’t limited to tariffs. U.S. actions over the past few months relating to diversity, equity and inclusion (DEI); LGBTQ+ rights; immigration; and more issues appear to be having a deleterious effect on the business of many event professionals. The negative effects reported are wide ranging, including existential uncertainty; cost increases; funding cuts; immigration detention, arrest or deportation; speakers, attendees and exhibitors unable or unwilling to travel; and more. Many comments specifically cite fear, which is an incredibly powerful emotion.

Kimberly Gaiennie (MPI At Large), head of events at Scrum Alliance in Colorado, is seeing and expects only negative impacts: “We hold global events for an international audience across the globe. Attendees no longer feel safe traveling to or want to support our events in the U.S. We are already seeing a 40% decline. I think attendance will only continue to drop for our events in the U.S. I also anticipate we are not the only organization facing this challenge and it will have a ripple effect on the industry.”

A U.S.-based domestic association planner who requested anonymity shared: “A lot of our members/attendees are federally funded, and the [executive orders] have either made it more difficult to fund their organizations and/or programs or more difficult to use federal funds for career advancement. Our members are theoretically funded until the end of the government’s fiscal year, [but] we are anticipating severe cuts for FY2026 as we anticipate the U.S. administration and Congress viewing the funding of our members as ‘waste.’”

"Attendees no longer feel safe traveling to or want to support our events in the U.S. We are already seeing a 40% decline. I think attendance will only continue to drop for our events in the U.S."

Numerous other event professionals also shared existential concerns in which they fear that funding cuts to their attendees/members will, in turn, eat away at their own businesses and events.

“Our membership is made up of DEI professionals as well as women, gender and sexuality studies scholars. These people are losing their jobs, departments, centers and more,” said a U.S.-based planner who requested anonymity. “Because of this they are unable to pay dues or register for our annual conference.”

Another U.S.-based planner who requested anonymity said: “I have clients that have lost funding due to DEI initiatives being cut as well as government employees being let go and those still in place not able to travel for conferences in April and funding lost for a conference in October. My clients are reconsidering what services that we normally provide they can cut for overall savings.”

Brett Augustine (MPI Dallas/Fort Worth Chapter), SVP client engagement at Manor Hill Productions, is also seeing the consequences of uncertainty with funding: “Our clients are planning to scale back their production and/or are planning to have less meetings in general. Some are afraid that funding for their organization will be randomly terminated, by outside sources, such as DOGE. I think many international groups will shift their meetings outside of the U.S.”

DOGE, the Elon Musk-backed Department of Government Efficiency initiative, appeared as a factor in numerous additional comments, all relating to funding loss or complete shut downs.

“We have lost contracted business due to the DOGE cutbacks,” said Lynne Krekelberg (MPI Carolinas Chapter), corporate and SMERF sales manager at Windsor Hospitality Group. “We will see a decline in RFPs for organizations that have lost their funding. This will have a negative impact on our overall contracted revenue.”

Indeed, while 75% of respondents to the Q2 2025 Meetings Outlook survey reported that U.S. actions are already having a negative impact on their business, professionals involved with association and government events appear to be slightly more impacted (79% and 83%, respectively). Furthermore, respondent comments suggest that scientific, medical and academic events, specifically, may be more prone to greater disruption.

Insight on the positive

The U.S. administration’s actions are credited with creating positive effects on event businesses, too, with 13% of respondents experiencing both positive and negative effects—but just 1% citing only positive effects.

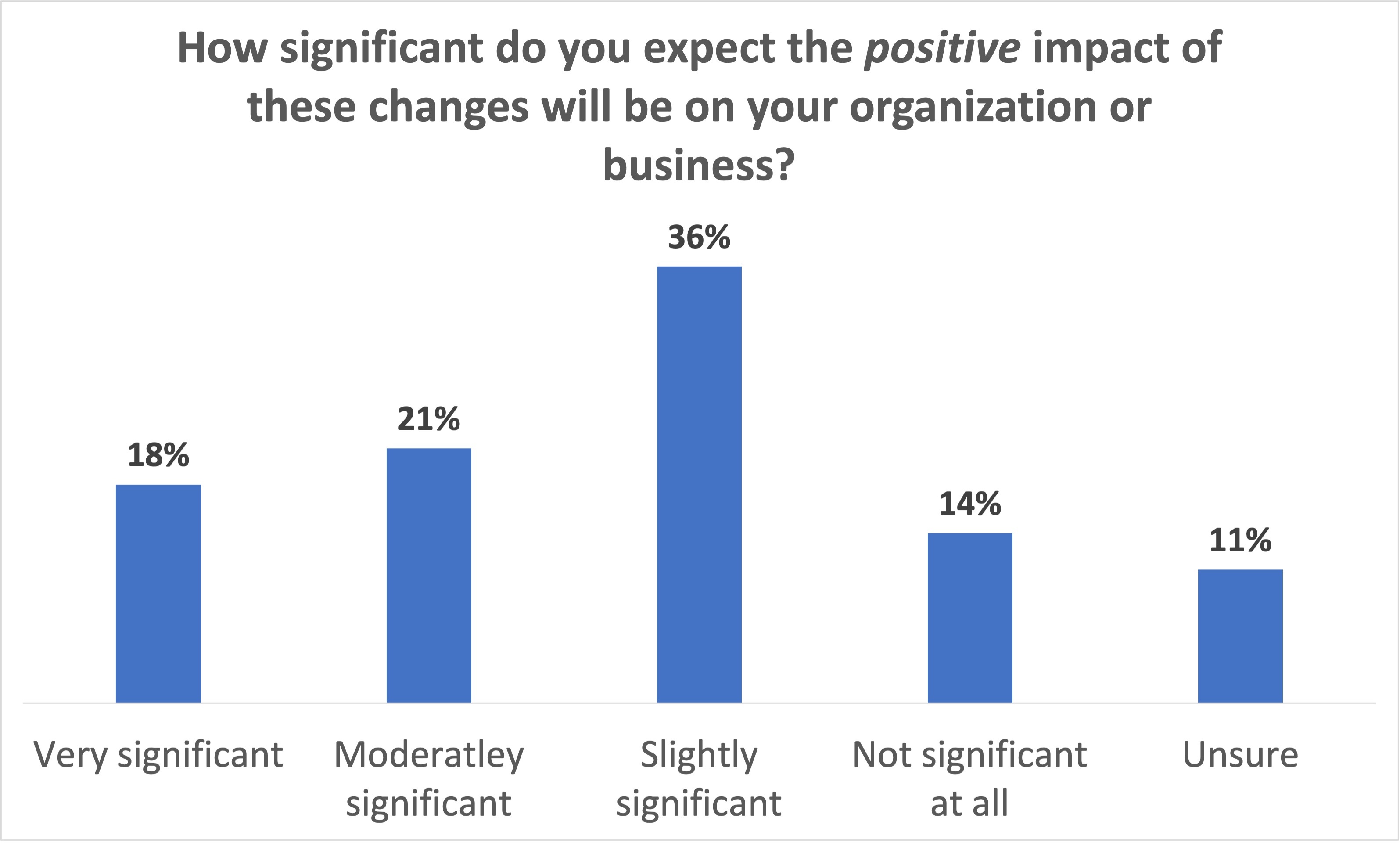

In addition to positive effects being much less widespread than the negatives, Meetings Outlook data suggests the positives are also, overall, less significant than the negatives. (Because so few respondents cited any positive effects, we can only say that the data “suggests” this.)

Curiously, respondents espousing positive impacts are predominantly from outside of the U.S., with Canada a stand out.

One Canadian supplier respondent who requested anonymity commented that they’re experiencing only positive effects as a result of the U.S. executive orders and policy changes because groups—especially domestic Canadian associations and international associations—are specifically seeking host destinations not located in the U.S.

Yet, even though the above supplier’s business is bolstered by more groups booking events in Canada, they expect these recent actions will cause some negative side effects in the future, noting specific concerns that attendance will be hindered if delegates, exhibitors and/or other stakeholders from the U.S. are unable or afraid to participate.

Tim Whalen, CMP (MPI Toronto Chapter), strategic manager of resort sales, Fallsview Casino Resort, noted both positive and negative impacts.

“The meeting industry as a whole will be hurt by lack of travel across the Canada-U.S. border,” he said in his survey comments. “[But] as a venue that books mostly Canadian business, we hope to see more business staying home in our country [from] groups that typically go to the U.S.”

A planner in Canada who requested anonymity and is seeing and expects impacts in line with those shared by Whalen similarly explained the good and the bad, respectively: “Canadian [organizations] are cancelling U.S. programs and rebooking in Canada. [We] lost a large contract due to DOGE funding cuts and negative Canadian rhetoric.”

This data is part of the larger Q2 2025 Meetings Outlook report, which will be published online in the second half of May. Additional key findings from this research will be shared on the MPI blog in the weeks ahead.