Every October at IMEX America, the global incentive travel community pauses to take stock. The Incentive Travel Index (ITI), produced annually by the Incentive Research Foundation (IRF) and the SITE Foundation in partnership with Oxford Economics, has become the industry’s barometer, a data-rich snapshot of where we stand and where we’re headed.

This seventh edition, based on responses from more than 2,700 professionals across 85 countries, reveals an industry that remains resilient and inventive but faces growing complexity. Incentive travel is as valued as ever, yet the business of delivering it grows tougher each year.

1. Growth continues, but the mood Is tempered

The Index shows that incentive travel remains a strong and stable segment within the wider business events ecosystem. Forty-one percent of buyers and DMCs report that more than half of their business events are classic incentive programs. However, optimism has moderated compared with last year.

While three-quarters of respondents agree that the value of incentive travel is “as strong as ever,” fewer now expect significant growth. In 2024, nearly half of buyers predicted that 2025 would see an increase in activity; in the latest survey, only 27 percent expect 2026 to outperform 2025. In other words, the industry is not shrinking but it’s no longer sprinting.

Regional differences are striking. APAC is the most optimistic, with 46 percent of buyers forecasting increased activity through 2027, compared with 32 percent in Europe. The pharmaceuticals, healthcare, and tech sectors show the highest confidence, seeing incentive programs as critical tools in talent retention and culture building.

2. Budgets rising—but so are costs

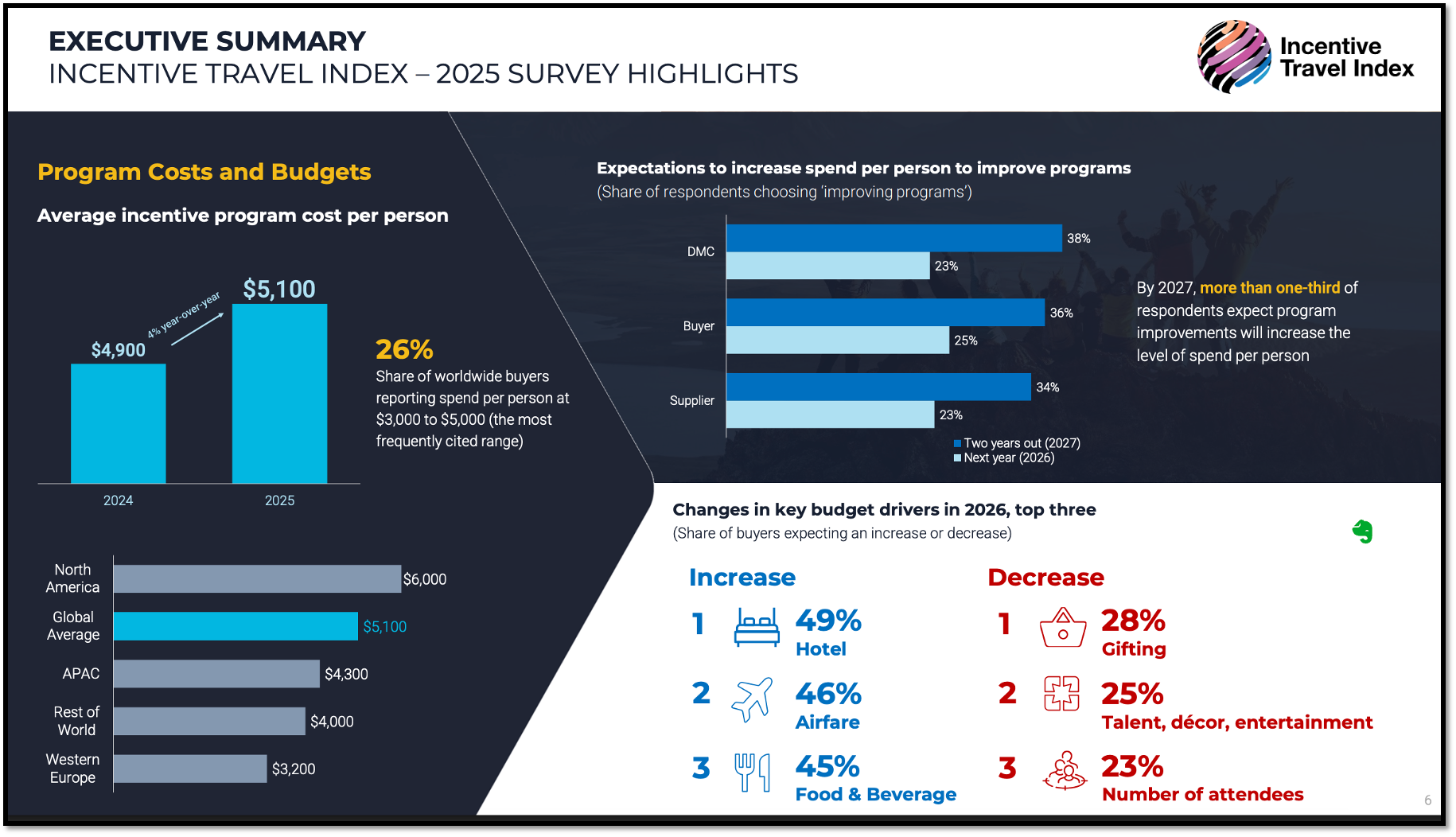

Average per-person spend has climbed to $5,100, up 4 percent year-on-year. North America leads with $6,000 per head, while Europe trails at $3,200 after a 20 percent drop. The global rise in hotel, air, and F&B costs, now accounting for nearly half of total program budgets, explains much of that increase.

Yet there’s more nuance. Many respondents (especially DMCs) expect future spending growth to come less from inflation and more from program improvements: better experiences, venues, and accommodations. Western European planners are the most ready to raise budgets to upgrade quality, while North Americans are more conservative.

Still, the squeeze is real. A quarter of buyers plan to “trim” 2026 programs, most often by cutting gifting, shortening trip duration, or opting for less expensive destinations. Another quarter intend to “improve” their programs instead, investing in higher-end lodging and richer activities. The duality captures the current moment perfectly: cautious optimism paired with creative restraint.

3. The reign of the “classic incentive”

Rumors of the death of the traditional, qualification-based incentive trip have been exaggerated. Two-in-five buyers expect to see more use of classic qualification programs, while 44 percent disagree that there will be an increase in inclusive, company-wide travel without performance criteria.

The hierarchy of what makes these trips successful is equally telling. Group dining and cultural sightseeing experiences top the list, followed closely by relationship-building activities and, rising sharply in importance this year, free time. The shift toward unstructured downtime is most evident in North America, while Asia-Pacific programs still favor communal experiences and symbolic group moments.

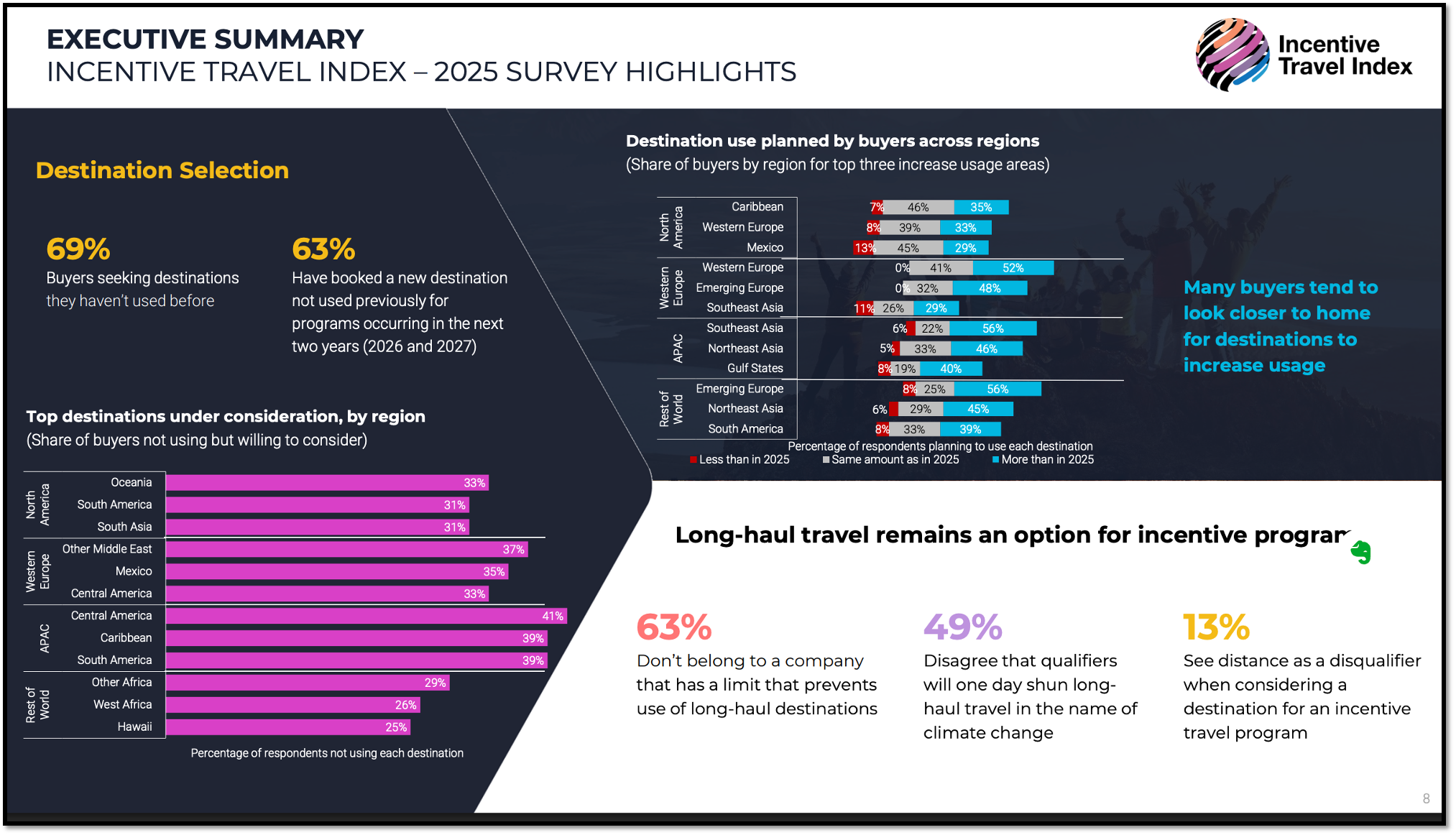

4. Destination dynamics: New, near and safe

If there’s one clear directional trend, it’s this: incentive travel is venturing into new places while staying closer to home. Nearly 70 percent of buyers say they are actively seeking destinations they’ve never used before, and 63 percent already have one booked for 2026 or 2027. At the same time, 44 percent are deliberately choosing shorter-haul destinations.

Safety has re-emerged as a paramount concern. Seventy-three percent cite personal safety as their top destination consideration, followed by cost and geopolitical stability. Direct air access and top-tier accommodations remain the most desired “must-haves,” with the presence of a capable DMC now ranking third, proof of how vital local expertise remains.

All-inclusive resorts are gaining ground (42 percent expect to use them more), driven by budget control, improved product quality, and convenience. Cruises, particularly river and Mediterranean sailings, show mixed signals but continue to appeal for their “multiple ports of call” and perceived value.

And what of long-haul travel? Despite growing sustainability discourse, most companies have no policy limiting it. Only 13 percent see distance as a disqualifier, and just 18 percent believe long-haul incentives will soon be unjustifiable. The skies, it seems, remain open.

5. The challenges ahead

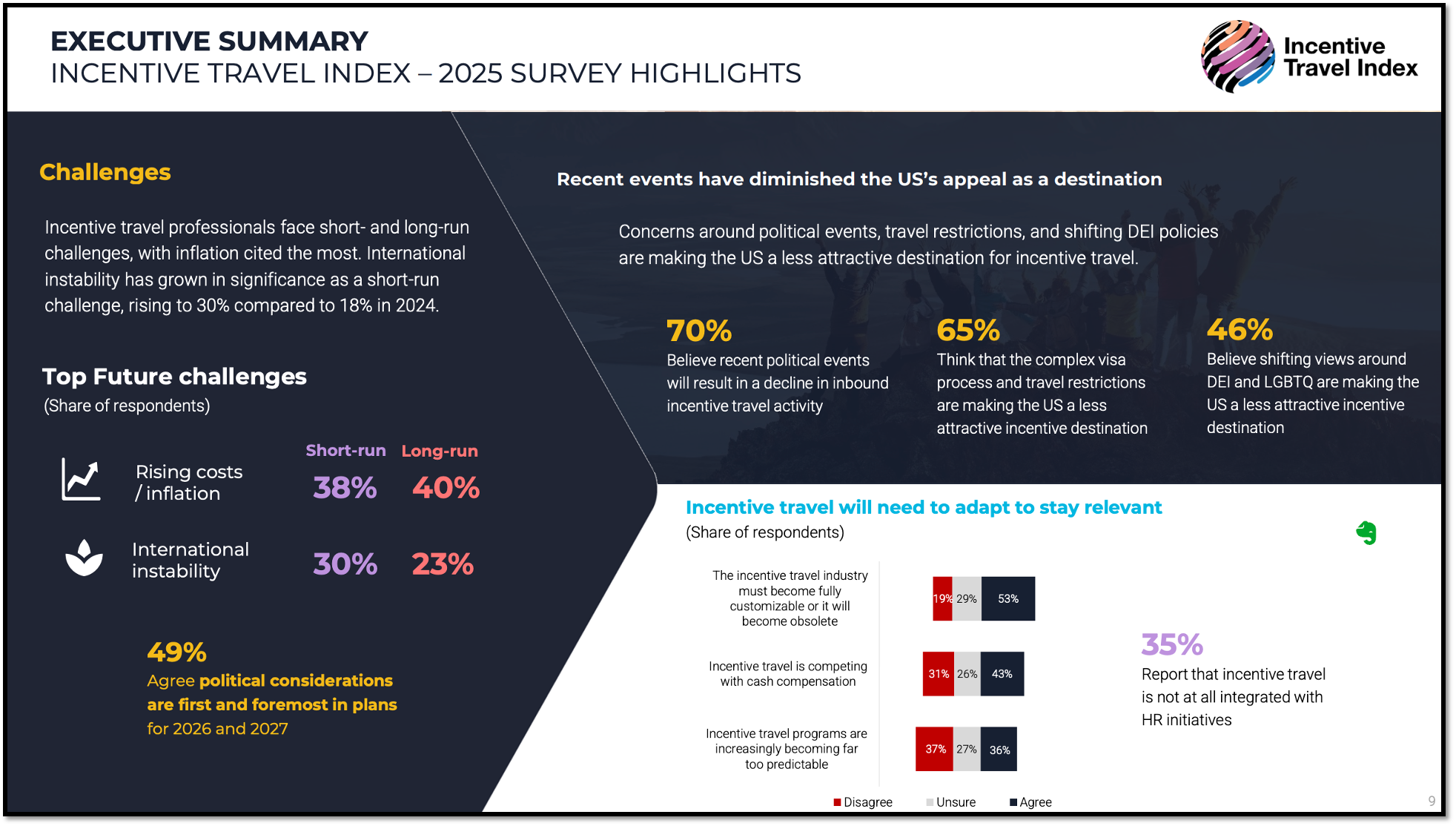

The Index paints a picture of an industry navigating turbulence. Rising costs and international instability top the list of short-term challenges, cited by nearly 40 percent of respondents. Over the long run, attracting and retaining talent emerges as the most pressing issue, followed by sustainability.

Political considerations are also reshaping destination selection. Almost half of respondents admit that geopolitics, that is, how a destination is perceived internally and externally, now outweighs other factors. Nowhere is this more apparent than in the United States:

70 percent believe recent political events will cause a decline in inbound incentive travel to the U.S.

65 percent cite visa and travel restrictions as deterrents.

46 percent say shifts in DEI and LGBTQ policies make the U.S. less attractive for both sponsoring companies and participants.

At the same time, the Index shows that only one-quarter of organizations fully integrate incentive travel within their HR strategy, while more than one-third treat it as a stand-alone reward mechanism. That gap represents both a challenge and an opportunity: incentive travel’s strategic value is widely recognized but not yet structurally embedded.

6. Industry evolution: Pricing, people and platforms

The Index also introduces a new line of inquiry into how incentive travel is bought and sold. The traditional percentage-based pricing model still dominates, used by 31 percent of agencies, while only 20 percent report using open-book or billable-hour structures. Nearly 60 percent remain unsure whether the industry will ever transition to the latter.

Relationships between buyers and suppliers remain “complex,” with 48 percent describing them as challenging or uncertain. Agencies tend to see more friction; hotels and resorts are notably more positive. These tensions echo a maturing industry wrestling with transparency, margin pressure, and shifting client expectations.

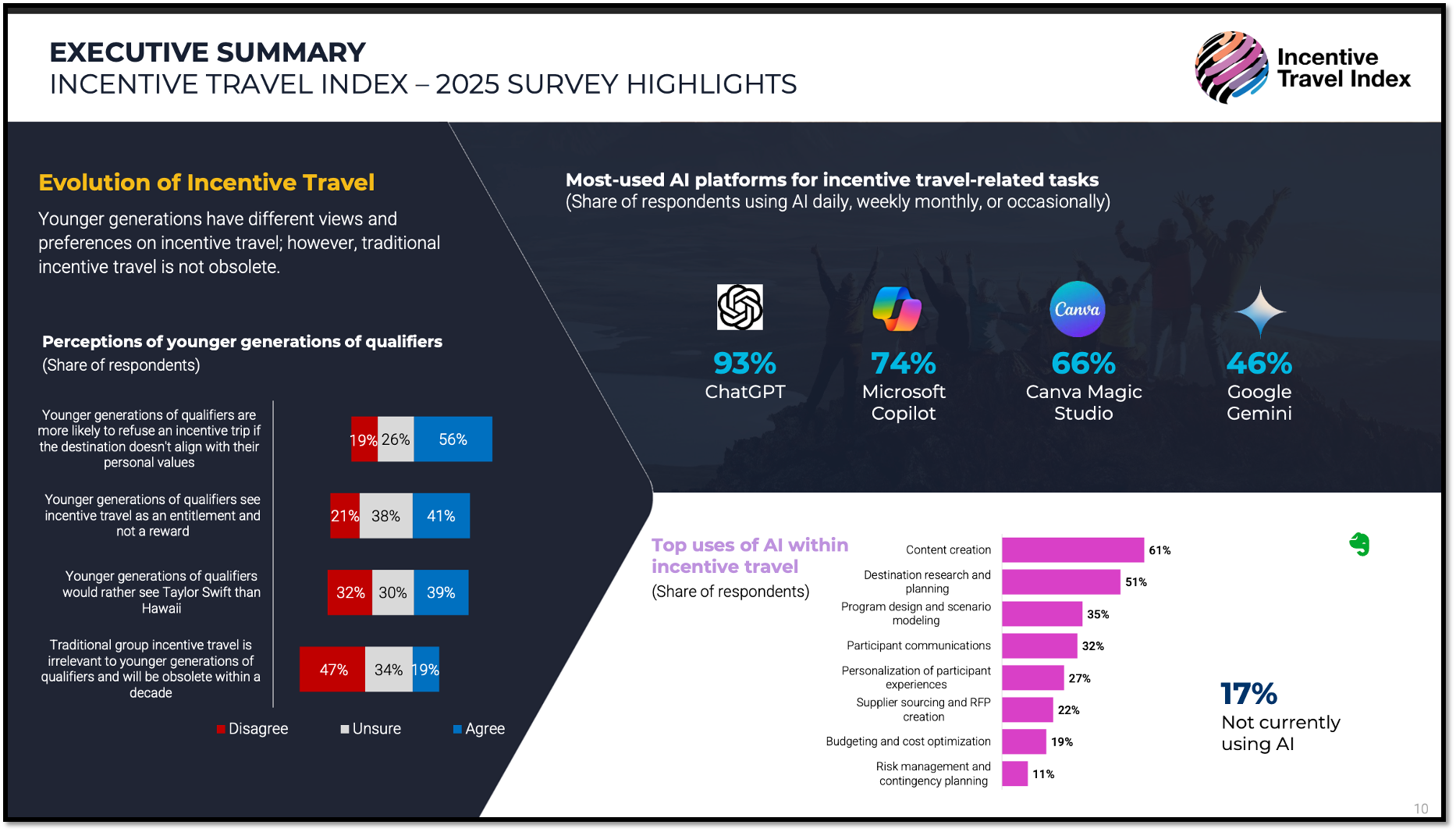

Technology is also rewriting the rulebook. A striking 93 percent of respondents report using ChatGPT, 74 percent use Microsoft Copilot, and 66 percent use Canva Magic Studio. Most deploy AI for content creation and destination research, while a smaller but growing share uses it for program design, scenario modeling, and participant communications. AI, once theoretical, is now operational.

7. Generational shifts: The Taylor Swift question

Perhaps the most talked-about finding from ITI 2025 is the now-famous question: Would Gen Z rather see Taylor Swift than Hawai‘i?

Thirty-nine percent of respondents agreed, 32 percent disagreed, and 30 percent were unsure, numbers that reveal both curiosity and caution. More telling, though, is what lies beneath the quip. Two-thirds of respondents (67 percent) believe younger generations of qualifiers will drive a powerful “retool” of incentive travel.

More than half say younger participants will decline trips that don’t align with their values. Forty-one percent believe this cohort views incentive travel as an entitlement rather than a privilege. And yet, nearly half (47 percent) disagree that group incentive travel is becoming obsolete. The future, it seems, belongs to programs that blend purpose with pleasure, reward with relevance.

8. Redefining purpose and value

Behind all the data runs a quiet but decisive theme: the evolution of purpose. Fifty-five percent of senior leaders now view incentive travel as essential to their company’s success, not merely a perk. Forty-three percent want programs that deliver both ROI and culture-building.

This dual demand, hard-power metrics and soft-power meaning, marks a major turning point. Incentive travel is no longer just about “earning the trip.” It’s about belonging, recognition, and shared identity. Companies are using it to reinforce values, nurture loyalty, and humanize the workplace.

As the research shows, the most successful programs of the future will be those that integrate all three dimensions:

Strategic alignment: connecting incentives with broader people strategy.

Experiential creativity: designing moments that move participants emotionally.

Operational intelligence: leveraging AI and data to measure and adapt impact.

9. The road ahead

So, what does the Incentive Travel Index 2025 ultimately tell us about the future?

That the industry’s fundamentals—recognition, connection, transformation—remain unshaken. But its context is shifting fast. Costs are up, travel patterns are shorter, politics are louder, and generations are rewriting the rules of motivation.

The next chapter of incentive travel will belong to those who can hold both truths at once: the enduring magic of shared experience and the emerging mandate for accountability, inclusion, and meaning.

Or, to put it another way: the trip still matters. But why we take it, and what we bring back, matters even more.

.jpg?sfvrsn=96553155_1)